For importers and wholesale distribution companies, managing Letter of Credit (LC) purchases is a critical aspect of ensuring compliance with tax authorities, particularly in Saudi Arabia. The ALZERP Cloud ERP Software offers a specialized LC Data Entry feature tailored for VAT and tax management. This tool is indispensable for businesses that need to maintain precise records of their LC imports, separate from their stock-inventory management, to comply with Zakat, Tax, and Customs Authority (ZATCA) regulations.

ALZERP understands the unique needs of import and wholesale distribution companies in Saudi Arabia. ZATCA, the Saudi Arabian tax authority, often requires detailed records of Letter of Credit (LC) imports for verification purposes. ALZERP’s LC Data Entry feature provides a dedicated tool to manage LC purchases specifically for VAT and tax management, ensuring compliance while simplifying workflows.

Why Use a Separate LC Data Entry for VAT and Tax Management?

- Maintains Price Discrepancies: ALZERP separates LC data from stock management, allowing you to record the difference between the actual vendor price and the customs declaration price. This ensures accurate VAT calculations based on the true value of the import.

- Streamlines VAT Reporting: ALZERP tracks VAT associated with LC purchases, simplifying VAT return filing and reducing the risk of errors.

- Simplifies ZATCA Audits: Maintain a centralized repository of all LC-related documents for easy access during ZATCA audits.

Key Features of ALZERP’s LC Data Entry

- Detailed Information: Capture essential details about your LC, including product information, order details, LC general information, and LC transactions.

- Document Management: Upload and store all relevant documents associated with the LC, including proforma invoices, cargo invoices, customs declarations, and bills of lading/airway bills. This eliminates the need for physical storage and facilitates easy retrieval during audits.

- Customizable Reports: Generate reports summarizing LC data, facilitating analysis and ensuring compliance with ZATCA regulations.

- ZATCA Compliance: ALZERP’s LC Data Entry aligns with ZATCA requirements, helping you meet all tax obligations.

Why LC Data Entry Matters for VAT and Tax Compliance #

In the context of VAT and tax management, LC purchases require meticulous documentation because tax authorities frequently request detailed records of these transactions. Unlike regular purchases that directly affect stock-inventory, LC purchases in ALZERP are managed separately within the VAT and tax management module. This separation is crucial because it allows businesses to distinguish between the actual vendor price and the customs-declared prices, which often differ.

By using ALZERP’s LC Data Entry tool, businesses can ensure that their VAT and tax records are accurate, comprehensive, and compliant with ZATCA’s requirements. This feature provides a structured approach to managing LC purchase records, including the ability to upload and store all related documents such as proforma invoices, cargo invoices, customs duties, and bills of lading (BL) or airway bills.

Comprehensive LC Data Entry Form #

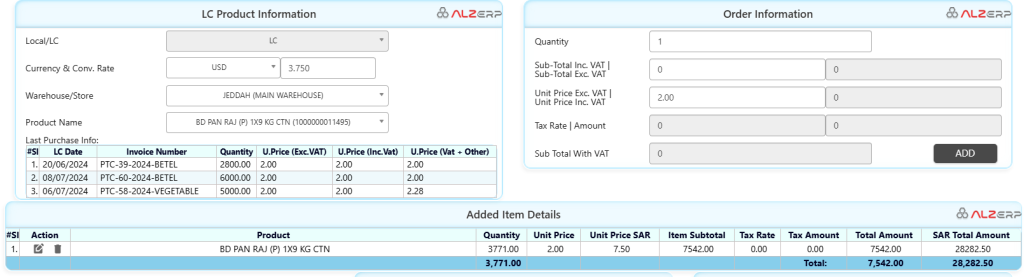

The LC Data Entry form in ALZERP is designed to capture all necessary details related to LC purchases. This form includes various fields and sections that allow businesses to input and track detailed information:

- LC Product Information: This section captures the essential details of the LC purchase, including product name, quantity, unit price (excluding and including VAT), and the warehouse or store where the goods are stored.

- Order Information: Here, businesses can input the quantity of goods ordered, the subtotal (including and excluding VAT), and the applicable tax rate. This ensures that all financial details are accurately recorded.

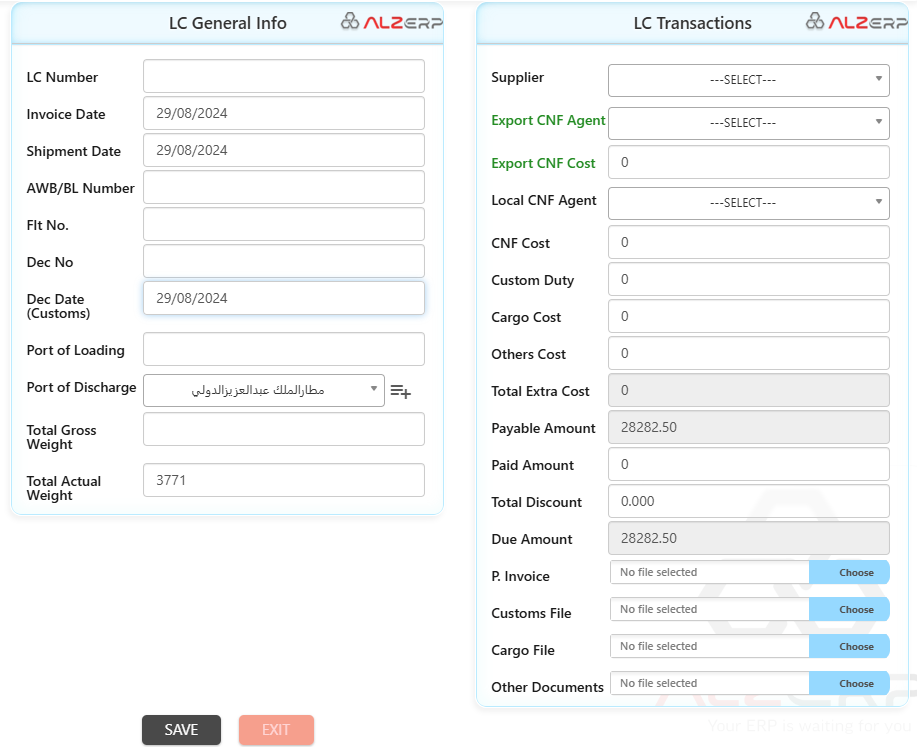

- LC General Info: This section records general information about the LC, such as the LC number, invoice date, shipment date, AWB/BL number, and port of loading and discharge. This information is crucial for tracking the movement of goods and ensuring compliance with import regulations.

- LC Transactions: This part of the form allows businesses to record all associated costs, including CNF (Cost and Freight) costs, customs duties, cargo costs, and other expenses. It also tracks the total payable amount, paid amount, discounts, and due amounts.

- Document Uploads: Businesses can upload and save all LC-related documents, ensuring that they are easily accessible for tax audits or inquiries. Documents such as the proforma invoice, customs file, cargo file, and other relevant paperwork can be stored securely within the system.

ALZERP: A ZATCA-Compliant Software Solution #

As a ZATCA-approved ERP and ZATCA-compliant e-invoicing system, ALZERP offers a comprehensive suite of tools for VAT management, Zakat calculation, and overall tax management in Saudi Arabia. The software’s LC Data Entry feature is a cornerstone of its tax compliance capabilities, providing a robust platform for managing Letter of Credit (LC) purchase records separately from regular inventory management.

Key Features of LC Data Entry in ALZERP

- Separate LC Purchase Records: The system maintains a distinct process for LC purchases, allowing businesses to track the difference between actual vendor prices and customs declaration prices. This separation is crucial for accurate VAT reporting and tax compliance.

- Comprehensive Data Capture: The LC Data Entry form in ALZERP captures all essential information, including:

- LC Product Information

- Currency and Conversion Rates

- Warehouse/Store details

- Last Purchase Information

- Order Information with VAT calculations

- LC General Info (LC Number, Invoice Date, Shipment Date, etc.)

- LC Transactions (Supplier, CNF Agents, Costs, etc.)

- Document Management: ALZERP allows users to upload and store all LC-related documents, including:

- Proforma Invoices

- Cargo Invoices

- Customs Duty declarations

- BL/Airway Bills

- Flexible Reporting: The system can generate comprehensive reports, allowing businesses to print all documents together or separately as required by VAT and tax authorities.

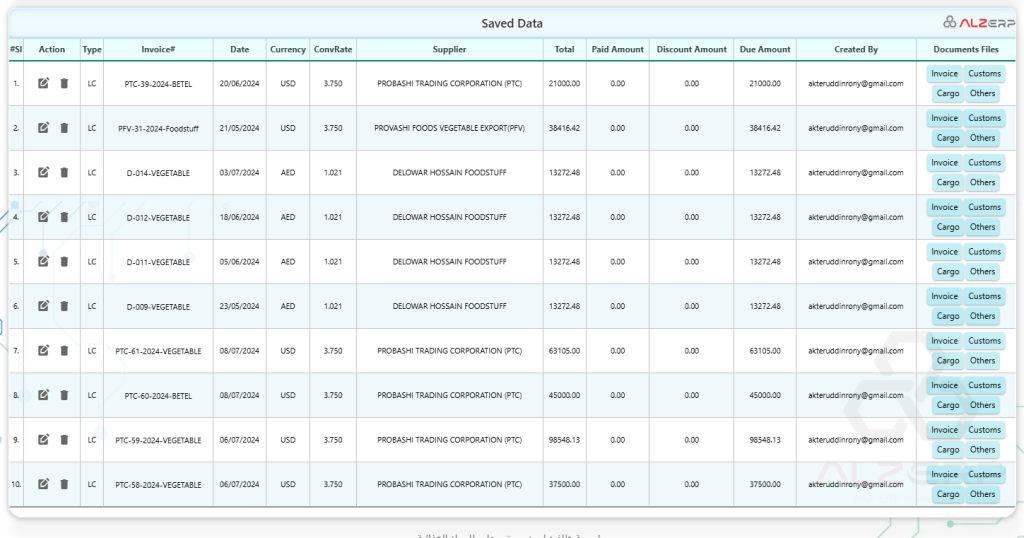

- Historical Data Access: ALZERP maintains a searchable database of saved LC data, enabling quick access to historical records for audit purposes.

ZATCA Compliance and Tax Management #

ALZERP’s LC Data Entry feature is designed with ZATCA compliance in mind, offering:

- Real-time VAT Reporting: The system calculates VAT in real-time, facilitating accurate and timely reporting to ZATCA.

- Zakat and Tax Automation: By maintaining detailed records of imports and associated costs, the system aids in accurate Zakat calculations and overall tax management.

- VAT Return Automation: The comprehensive data capture enables automated generation of VAT returns, streamlining the compliance process.

- ZATCA Data Submission: The system is equipped to generate reports in ZATCA-approved formats, facilitating smooth data submission to the authority.

- Tax Audit Support: With its detailed record-keeping and document management capabilities, ALZERP provides robust support during tax audits.

Seamless LC Management Without Impacting Stock-Inventory #

One of the standout features of ALZERP’s LC Data Entry tool is its ability to manage LC purchases separately from the stock-inventory. This distinction is vital for accurately reflecting the financial impact of LC transactions without affecting inventory levels. While the LC purchase under the VAT and tax management module focuses on maintaining accurate financial records, the purchase management module within ALZERP handles the actual product pricing with exporters, affecting the inventory.

This dual approach ensures that businesses can maintain accurate financial records for tax purposes while also keeping their inventory management in check. The ability to separate these two aspects of LC purchases is particularly beneficial for businesses that deal with complex import processes and need to ensure that their financial records are both accurate and compliant with regulatory requirements.

Ready for Tax Audits and Compliance Checks #

In the event of a tax audit or inquiry from the tax authorities, ALZERP’s LC Data Entry feature ensures that businesses are fully prepared. All relevant documents and records can be quickly retrieved, printed, and submitted as needed. The software’s ability to consolidate and print all related documents—such as proforma invoices, cargo invoices, customs declarations, and more—either individually or collectively, makes it easier for businesses to respond to tax authorities’ requests promptly.

Key Benefits of ALZERP’s LC Data Entry for VAT and Tax Management #

- ZATCA-Compliant Software: ALZERP ensures that all LC-related transactions are managed in full compliance with ZATCA’s regulations.

- Accurate VAT Management: The software provides detailed tracking and reporting of VAT on LC purchases, ensuring that businesses can accurately report their VAT obligations.

- Zakat Calculation Software: ALZERP supports comprehensive zakat calculation, including all relevant data from LC purchases.

- Tax Management System: The LC Data Entry tool is part of ALZERP’s broader tax management system, which streamlines tax reporting and compliance.

- ZATCA e-Invoicing Solution: ALZERP’s integration with ZATCA’s e-invoicing system ensures that all invoices related to LC purchases are compliant with Saudi regulations.

- Real-Time VAT Reporting: Businesses can generate real-time reports on VAT and LC purchases, ensuring they always have up-to-date financial data.

- Automated Tax Compliance: ALZERP automates various aspects of tax compliance, reducing the administrative burden on businesses.

- Secure Document Management: All LC-related documents are securely stored within the system, ensuring they are readily available for audits or compliance checks.

- Seamless Integration: The LC Data Entry tool integrates with other modules within ALZERP, providing a comprehensive solution for tax and VAT management.

- Audit Preparedness: ALZERP’s robust reporting and document management features ensure that businesses are always ready for tax audits or inquiries.

Summary of Using ALZERP’s LC Data Entry

- Enhanced Efficiency: Simplify LC data entry and management, saving time and resources.

- Improved Accuracy: Reduce errors in VAT calculations and reporting.

- Simplified Audits: Ensure smooth and efficient ZATCA audits with readily available documentation.

- Reduced Risk of Penalties: Minimize the risk of penalties associated with non-compliance.

- Peace of Mind: Gain peace of mind knowing your LC data is managed effectively for VAT and tax purposes.

ALZERP empowers import and wholesale distribution companies in Saudi Arabia to manage LC data efficiently and ensure compliance with ZATCA regulations. With its dedicated LC Data Entry feature, you can streamline workflows, improve accuracy, and minimize risks associated with VAT and tax management.

Conclusion #

Managing LC purchases is a complex but essential part of VAT and tax management for importers and wholesale distributors. ALZERP Cloud ERP Software offers a powerful LC Data Entry tool that simplifies this process, ensuring that all LC-related transactions are accurately recorded and compliant with ZATCA regulations. By leveraging this tool, businesses can maintain precise financial records, streamline their VAT and tax reporting, and be fully prepared for any tax audits or compliance checks.

ALZERP’s LC Data Entry feature for VAT and Tax Management represents a significant advancement in tax compliance technology for Saudi businesses engaged in import and wholesale distribution. As a ZATCA-approved solution, it offers peace of mind to businesses navigating the complex waters of international trade and local tax regulations.

By providing a comprehensive, automated, and ZATCA-compliant system for managing LC purchases and associated tax liabilities, ALZERP enables businesses to focus on growth while ensuring they meet all regulatory requirements. In an era where tax compliance is increasingly scrutinized, ALZERP stands out as a valuable tool for Saudi businesses seeking to optimize their tax management processes.

With ALZERP, businesses can confidently manage their LC purchases, knowing that they have a reliable, ZATCA-approved solution that supports their compliance and financial management needs.