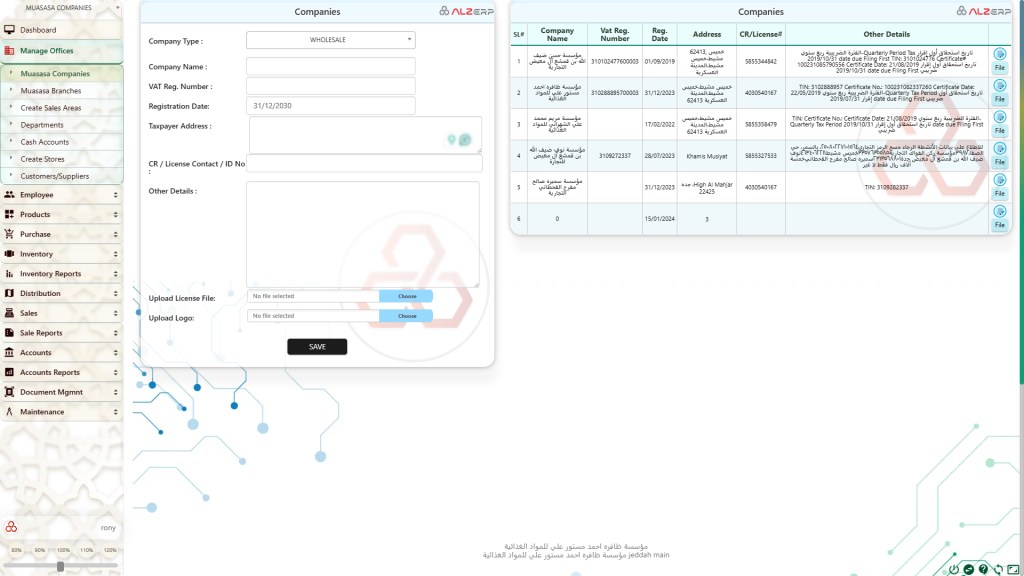

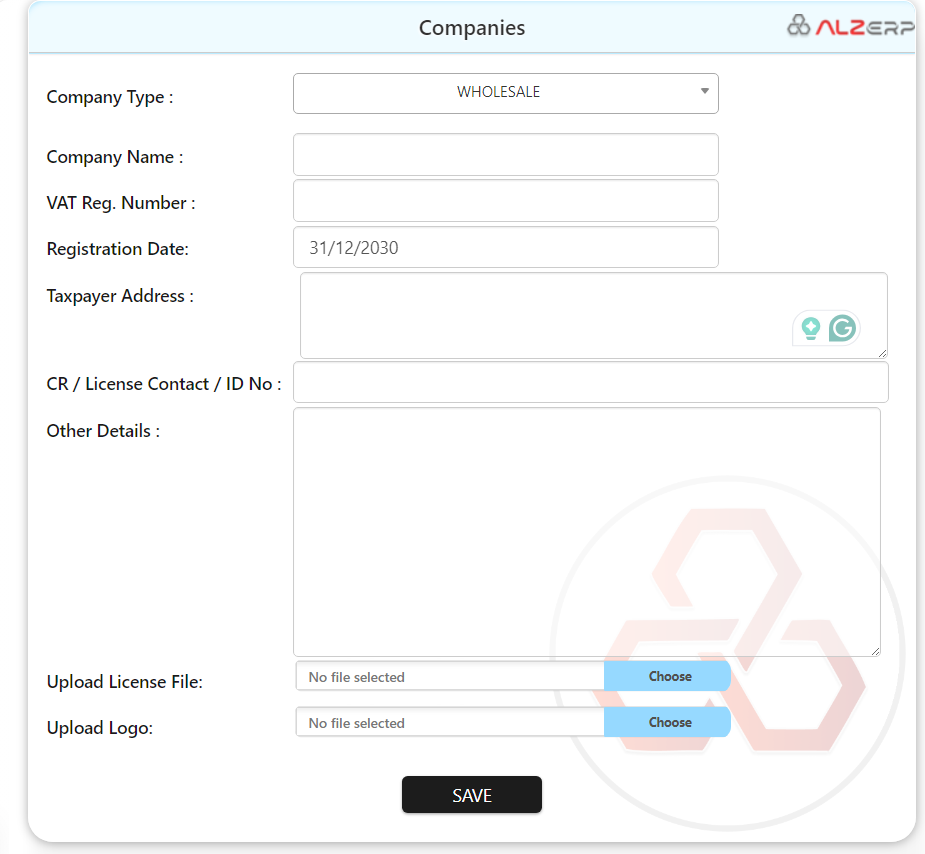

VAT (Tax Payer) Company Information Page in ALZERP software

The Company Information page contains the data you provided about your company during registration/ creating subscriptions in ALZERP cloud ERP software. These features are all part of ALZERP cloud ERP (Enterprise Resource Planning) software. Specifically, focus on managing your company’s information and legal standing. Here’s a breakdown of each feature:

- Company Type: This allows you to categorize your business as Wholesale, Retail, or potentially other options depending on the software.

- Company Name: Enter your legally registered business name.

- VAT Reg. Number: This field stores your Value Added Tax registration number, if applicable.

- Registration Date: The date your company officially registered for business.

- Taxpayer Address: The physical address associated with your tax registration.

- CR / License Contact / ID No: This can refer to your Commercial Registration (CR) number, business license number, or another unique identification number depending on your region’s regulations.

- Other Details: This field provides a space to include any additional relevant company information not covered by the other options.

- Upload License File: This allows you to upload a digital copy of your business license or other relevant legal document.

- Upload Logo: You can upload your company logo for branding purposes within the ALZERP software.

ALZERP: Your All-in-One ERP Solution

Running a business in Saudi Arabia requires managing a multitude of details. ALZERP simplifies this process by providing a centralized platform to store and manage all your company’s critical information, including:

- Company Types: Wholesale, Retail, and more.

- Tax and VAT Payer Information: Company name, VAT registration number, registration date, taxpayer address, CR/License number, contact details, and other relevant data.

- Document Management: Upload license files and company logos for easy access and record-keeping.

ALZERP empowers you to maintain organized and accurate company data, streamlining administrative tasks and ensuring compliance with regulations.

Streamline Your Business with ALZERP VAT Compliance software

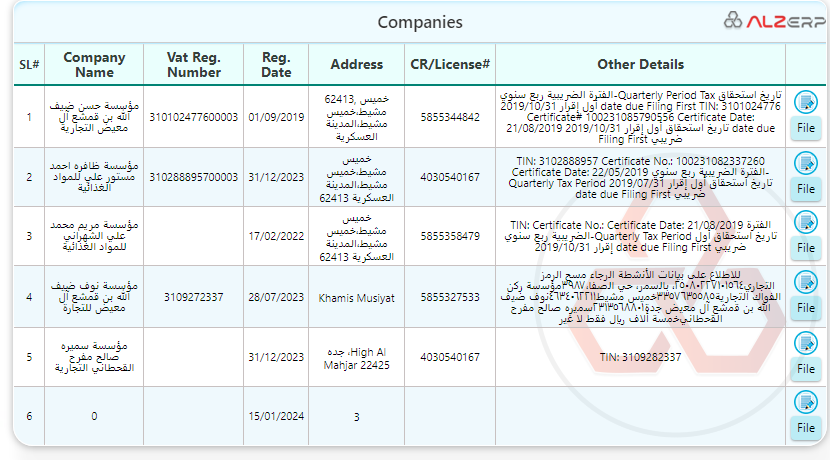

Before engaging in business transactions, it’s vital to verify the VAT registration status of your potential partners. ALZERP integrates seamlessly with the Zakat, Tax and Customs Authority (ZATCA) to enable quick and efficient VAT number verification. This verification ensures you’re dealing with VAT-compliant companies, protecting your business from potential tax liabilities.

Effortless VAT Registration with ALZERP

ALZERP guides you through the VAT registration process in Saudi Arabia. Here’s a simplified breakdown:

- Eligibility Assessment: Use ALZERP to determine if your company meets the VAT registration threshold.

- Data Collection: Gather all necessary information, including taxpayer name, CR/License number, and preferred tax period (monthly or quarterly).

- Application Submission: ALZERP streamlines the application process by electronically submitting your data to ZATCA.

- Review and Approval: ZATCA will review your application and notify you of the outcome.

- VAT Number Acquisition: Upon successful registration, you’ll receive your official VAT number.

Benefits of VAT Registration

Registering for VAT offers several advantages:

- Compliance: Ensures your business operates within Saudi Arabia’s tax regulations.

- Credibility: Demonstrates your commitment to responsible business practices.

- Input Tax Deductions: Allows you to claim back VAT paid on business expenses.

ALZERP: Your Partner in Business Success

By leveraging ALZERP’s comprehensive features and VAT compliance guidance, you can focus on running your business with confidence. Contact us today to learn more about how ALZERP can simplify your company management and ensure your VAT compliance in Saudi Arabia.

In today’s business landscape, managing tax and VAT obligations efficiently is crucial for companies to remain compliant and competitive. ALZERP’s Company Information Page offers a comprehensive solution for managing your company’s management information system, streamlining tax and VAT payer information storage and management in one centralized location.

With ALZERP, you can easily input and store vital company details such as Company Type, Wholesale Company Name, VAT Registration Number, Registration Date, Taxpayer Address, Contact/ID Number, and other pertinent information. Additionally, the platform allows you to upload essential documents such as licenses and logos for easy reference and verification.

One of the standout features of ALZERP is its VAT Taxable Person Lookup tool, which enables users to verify their establishment’s registration in VAT seamlessly. Powered by the Zakat, Tax, and Customs Authority, this service provides a reliable means of confirming VAT compliance, ensuring peace of mind for businesses.

For those looking to register for VAT, ALZERP simplifies the process with its user-friendly interface and step-by-step guidance. The article outlines the five-step process for VAT registration in Saudi Arabia, from submitting the application to receiving your VAT number. Additionally, it highlights the benefits of VAT registration, such as enhanced credibility and eligibility for input tax credit.

ALZERP software is designed to save businesses time and effort, with estimated turnaround times provided for each step of the application process. Whether you’re a small business or a large corporation, ALZERP’s VAT registration and verification capabilities offer a streamlined solution to meet your compliance needs.

In conclusion, ALZERP’s Company Information Page is a powerful tool for managing your basic company information with VAT & Tax information effectively. With its user-friendly interface, comprehensive features, and reliable support, ALZERP empowers businesses to navigate the complexities of tax and VAT compliance with confidence.