Net Profit Before Provision (NPBP) is a financial metric used in accounting that reflects the profitability of a company before accounting for specific reserves or contingencies. It represents the gross profit after deducting operating expenses but before setting aside funds for:

- Bad debts: This refers to money owed by customers that the company may not be able to collect.

- Depreciation: This is the gradual decrease in the value of an asset over time due to wear and tear or obsolescence.

- Taxes: This includes income taxes and other levies imposed by the government.

Here’s how NPBP fits into the bigger picture of a company’s financial statements:

- Revenue: This is the total income generated by the company from its core business activities.

- Cost of Goods Sold (COGS): This refers to the direct costs associated with producing or acquiring the goods or services sold.

- Gross Profit: Revenue minus COGS. It represents the initial profit earned after accounting for the direct costs of producing or acquiring the goods/services.

- Operating Expenses: These are indirect costs incurred to run the business, such as rent, salaries, marketing, and administrative expenses.

- Operating Profit: Gross Profit minus Operating Expenses. This reflects the profit earned from core operations after accounting for all direct and indirect costs.

- NPBP: Operating Profit minus provisions. Provisions are funds set aside to cover potential future expenses or losses.

Net Profit Before Provision (NPBP) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) are both profitability metrics used in accounting, but they calculate profit in slightly different ways:

Net Profit Before Provision (NPBP):

- Represents: A company’s operational profitability before accounting for certain non-cash expenses.

- Calculation: Generally, NPBP is not a standard accounting term. However, it can be estimated by subtracting all operating expenses from total revenue. Operating expenses typically include:

- Cost of goods sold (COGS)

- Selling, general & administrative expenses (SG&A)

- Research & development (R&D) expenses

Non-cash expenses typically excluded from NPBP are:

- Depreciation: The allocation of the cost of a tangible asset (like machinery) over its useful life.

- Amortization: The allocation of the cost of an intangible asset (like a patent) over its useful life.

- Provisions: These are liabilities that a company expects to incur in the future, such as for bad debts or restructuring costs.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

- Represents: A metric used to assess a company’s core operating profitability. It takes NPBP a step further by also removing interest expense.

- Calculation: EBITDA is a more standardized metric compared to NPBP. It’s calculated by adding interest expense, taxes, depreciation, and amortization expenses to a company’s net income (which already subtracts all operating expenses).

Why is NPBP important?

NPBP provides a preliminary view of a company’s profitability before considering specific contingencies. It can be used by investors and analysts to:

- Compare profitability across companies within the same industry, especially when accounting policies differ regarding provisions.

- Assess a company’s ability to generate future profits before taking into account potential future expenses like bad debts or additional taxes.

- Evaluate the effectiveness of a company’s core operations by isolating the profit earned from its primary business activities.

However, it’s important to note that NPBP is not the final measure of a company’s profitability. You should also consider:

- Net Profit: This is the final profit figure after deducting all expenses and provisions from revenue.

- Net Profit Margin: This metric expresses net profit as a percentage of revenue.

By analyzing both NPBP and other profitability measures, you can gain a more comprehensive understanding of a company’s financial health and performance.

Both Net Profit Before Provision (NPBP) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) are financial metrics used to evaluate the financial performance of a company. Here are their similarities and differences:

Similarities:

- Financial Metrics: Both NPBP and EBITDA are financial metrics used by companies and investors to assess profitability and operational performance.

- Focus on Operating Performance: Both metrics focus on the operating performance of a company by excluding certain non-operating expenses and income.

Differences:

- Calculation:

- NPBP: NPBP represents the net profit of a company before making provisions for specific expenses, such as taxes, interest, and extraordinary items.

- EBITDA: EBITDA represents a company’s earnings before considering the impact of interest, taxes, depreciation, and amortization.

- Inclusion of Non-Operating Items:

- NPBP: NPBP typically excludes non-operating items such as interest income, interest expenses, and extraordinary items.

- EBITDA: EBITDA excludes non-operating expenses like interest, taxes, depreciation, and amortization, but it may include some non-operating income.

- Treatment of Depreciation and Amortization:

- NPBP: NPBP includes depreciation and amortization expenses as part of operating expenses.

- EBITDA: EBITDA adds back depreciation and amortization to net income to arrive at operating income, as it is considered a non-cash expense.

- Use in Financial Analysis:

- NPBP: NPBP is often used by companies to assess their operating performance and make decisions related to provisions and expenses.

- EBITDA: EBITDA is commonly used as a measure of operating profitability and cash flow, especially in industries where depreciation and amortization expenses vary significantly.

- Applicability in Valuation:

- NPBP: NPBP may be used in valuation models, particularly when adjustments are needed to reflect the true earnings potential of a company.

- EBITDA: EBITDA is frequently used in valuation methods such as the enterprise value-to-EBITDA (EV/EBITDA) ratio to compare the value of different companies or assess acquisition targets.

EBITDA isn’t an official accounting term as NPBP is used officially by those recognized by standard accounting rules. However, some companies choose to mention EBITDA in their quarterly financial reports. They might also provide adjusted EBITDA figures which remove certain costs like stock-based compensation.

There’s been more attention given to EBITDA by both companies and investors lately. However, some people criticize it, saying it makes profits look better than they really are. To address this concern, the U.S. Securities and Exchange Commission (SEC) requires companies that mention EBITDA in their reports to explain how they calculated it from their net income. Additionally, companies aren’t allowed to present EBITDA figures on a per-share basis.

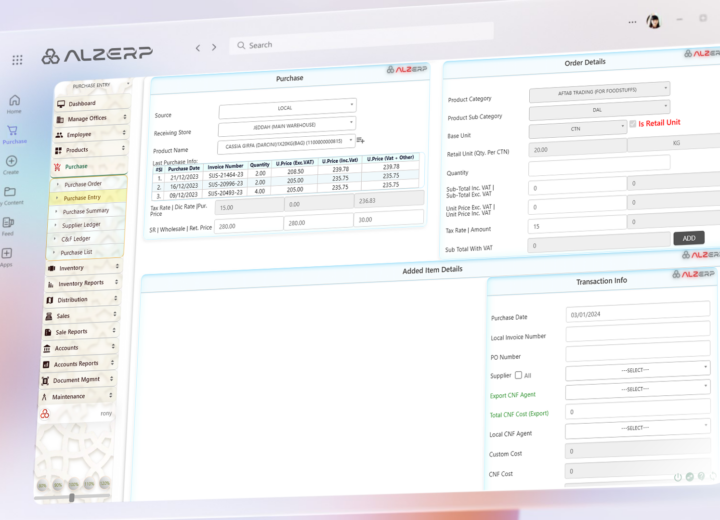

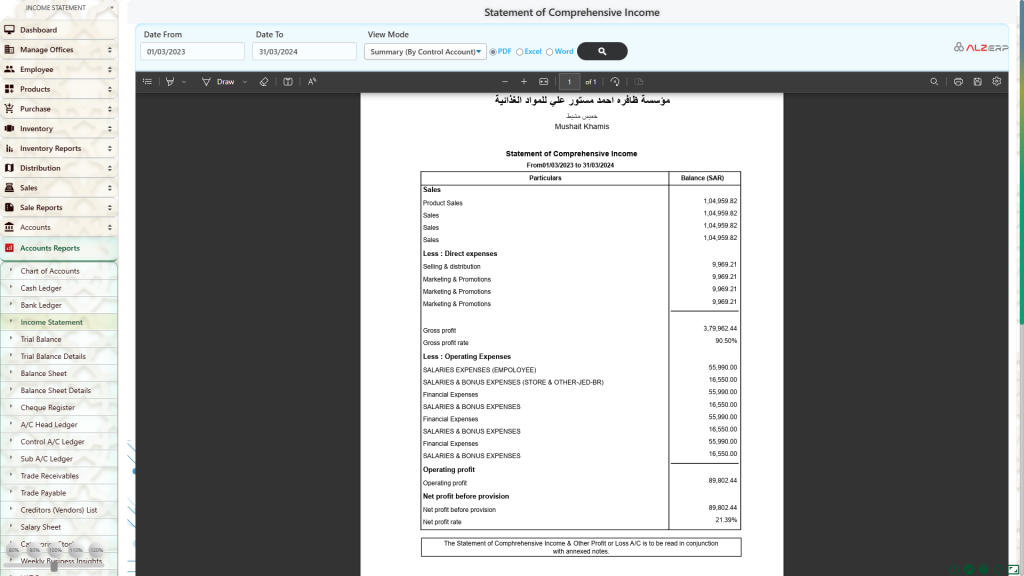

Signup today to start preparing your complete accounting reports and statements in ALZERP cloud accounting software at https://alzerp.com/