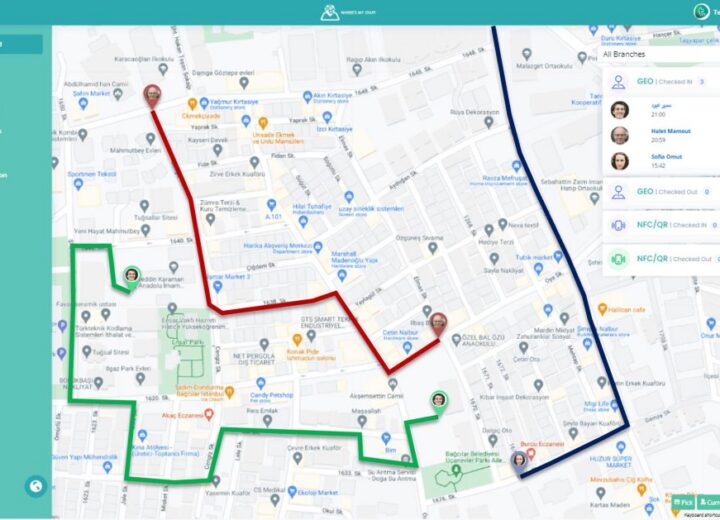

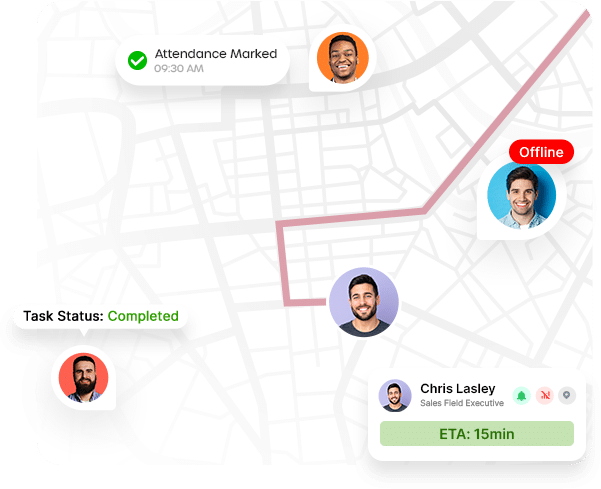

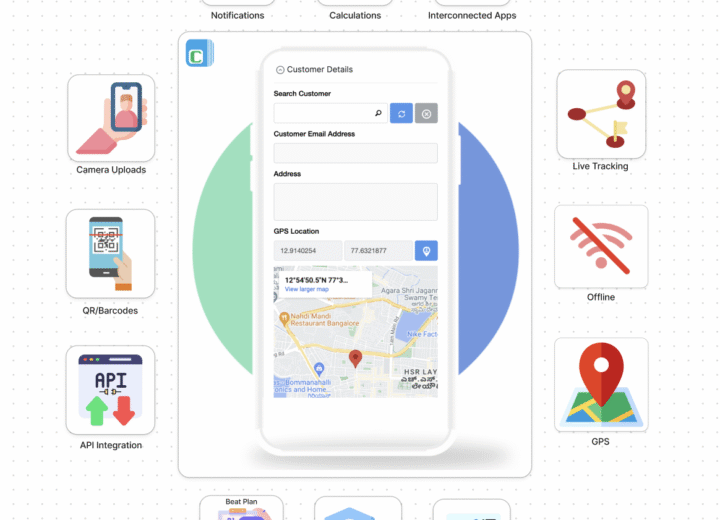

How ALZERP POS Delivers Enterprise-Grade Location Tracking for Mobile Sales Teams

When your salespeople are always on the move—visiting retailers, taking orders, delivering goods, collecting payments—visibility becomes one of the most valuable business assets.Whether you operate FMCG, wholesale distribution, logistics, or